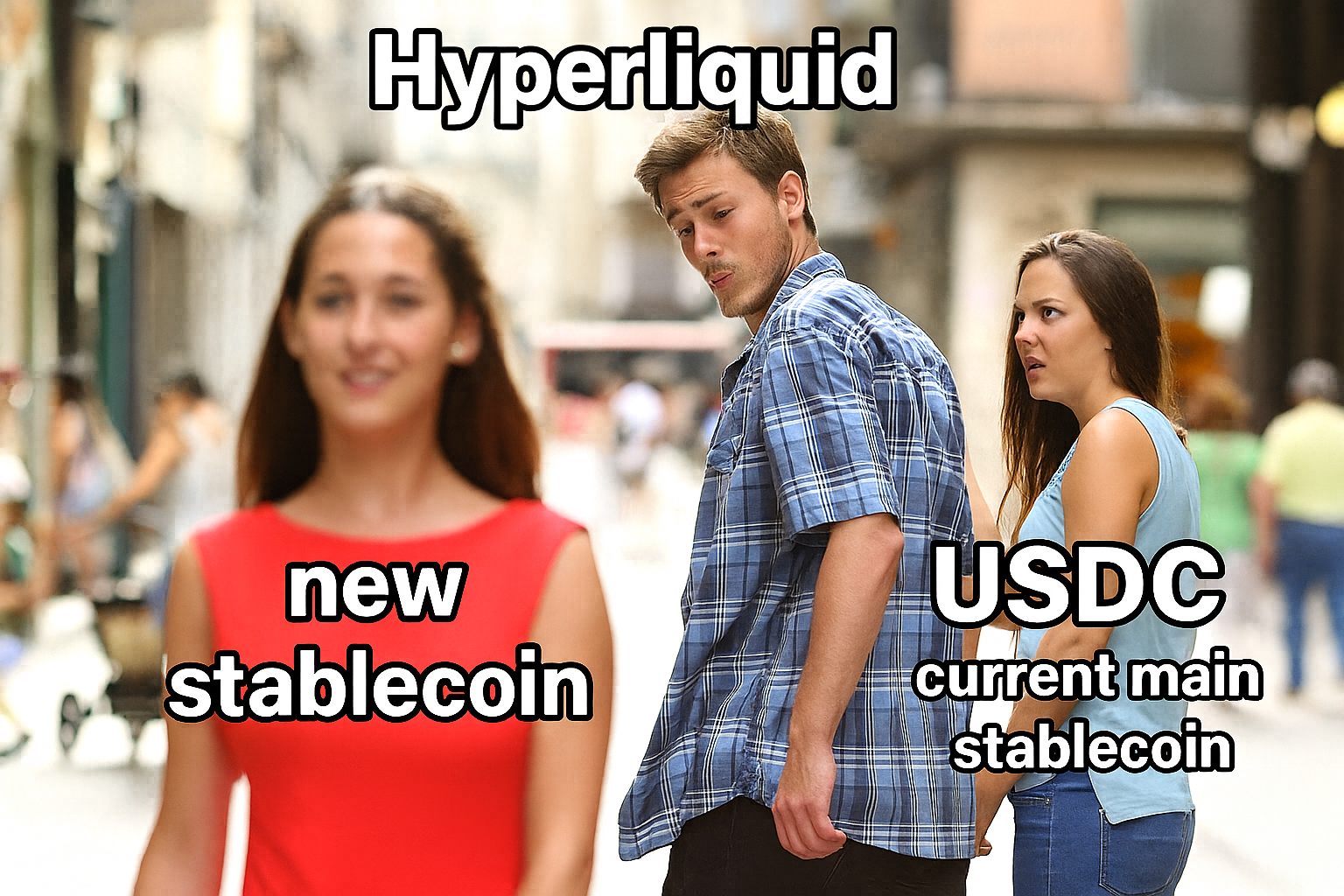

USDC Wasn't Enough? The USDH Debate

For the past few days, everyone’s been debating who will get the green light to issue the USDH stablecoin, which is supposed to become Hyperliquid’s main stablecoin.

The contenders are:

- Paxos and Agora, pushing for traditional regulated assets,

- Frax and Sky, offering DeFi-style solutions,

- Ethena, already behind the world’s third-largest stablecoin,

- Native Markets, who are planning to issue a stablecoin on Hyperliquid anyway, regardless of whether they’re allowed to brand it USDH.

All of this is exciting, but what I find more interesting is a different question:

Doesn’t Hyperliquid already have a main stablecoin?

From day one, Hyperliquid has been a derivatives exchange where everything settled in stablecoins. For deposits and withdrawals, there was just one option: USDC on Arbitrum. Sure, now there are more choices, but I’d say USDC is still the backbone of the platform: the majority of trades are denominated in it, most fees are paid in it, and the Assistance Fund uses it to constantly buy back HYPE tokens, keeping their price supported.

So what’s wrong with USDC? Why does Hyperliquid feel the need to replace it? By all accounts, it’s a solid stablecoin - many even see it as the most trustworthy one out there.

Circle’s shortcomings are well known, of course. They’re not so different from Tether’s: regular users can’t redeem their coins directly for dollars. In that sense, Paxos looks more attractive. But let’s be honest - nobody really cares about that.

So what’s the real reason? Why does Hyperliquid need yet another stablecoin? Aren’t there already too many of them floating around?

I’d really like to hear an answer to that. Right now, it all looks a bit odd.

That said, better too many than just one. Competition beats monopoly any day.

And don’t forget - you can swap any stablecoin for another at rabbit.io.