Why Bitcoin Hasn’t Become a Popular Payment Method

When someone “buries” Bitcoin, a common argument is that over 16 years, Bitcoin has failed to establish itself as a widely used payment method. And this is true. Why do so few people pay with Bitcoin, and does this mean Bitcoin has failed?

What Does an Asset Need to Become a Payment Method?

In countries where barter isn’t prohibited, people could theoretically pay with anything — cows, seashells, or even massive stone slabs. These assets were once used for payments, but today they’re far from popular. People prefer government-issued money.

Why? The answer is simple. For an asset to become a popular payment method, two factors are required:

- Willingness of sellers to accept the asset as payment for goods and services.

- Willingness of buyers to give this asset as payment for goods and services.

With government-issued currencies, this willingness is enforced by law: states mandate that their money must be accepted by sellers and offered by buyers. Are we forced to use them? Yes, but not entirely. Even voluntarily, we’d choose government money because we know: every counterparty is legally obligated to accept it.

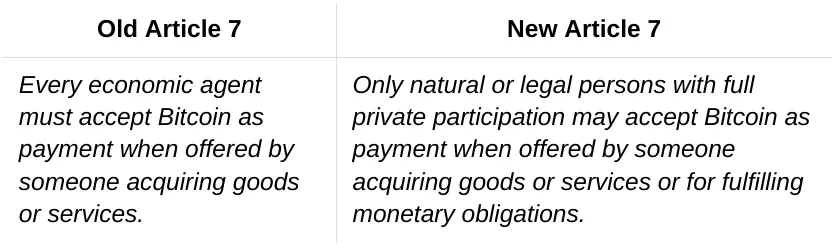

Bitcoin lacks this property. Until recently, El Salvador was an exception. But in late January, El Salvador’s “Bitcoin Law” was amended. Here is the translation by Samson Mow:

Additionally, in some countries, Bitcoin is prohibited for payments. For example, Egypt bans all cryptocurrency transactions. In Russia, buyers are allowed to use crypto for payments, but sellers cannot accept it (meaning crypto can only be used for transactions with foreign sellers).

At this point, the article could end here. After all, the answer to why Bitcoin hasn’t become a popular payment method seems clear: Bitcoin can’t compete with government currencies, which have the unique advantage of legal tender status.

But recently, Breez and 1A1z published a report on Bitcoin’s use as a payment method, claiming that Bitcoin payment infrastructure is rapidly evolving and Bitcoin is actively used in both traditional and digital economies.

In my view, the report’s authors confuse wishful thinking with reality, but it does shed light on why sellers and buyers might choose Bitcoin for payments.

What Makes Bitcoin Attractive to Sellers and Buyers?

Most narratives highlighted by Breez and 1A1z are well-known and straightforward.

For sellers, Bitcoin offers:

- Low entry barriers. To start accepting payments, no bureaucratic procedures or verifications are needed. You only need to provide the client with an address or invoice.

- Broader audience. Access to customers in regions with underdeveloped banking systems or where global payment providers don’t operate.

- Fast settlement. Especially with Lightning Network.

- Lower processing fees. Avoiding credit card fees (≈3.5%) or currency conversion costs.

- No chargeback risks. Eliminating administrative costs from disputed transactions.

- Revenue growth. For example, domain registrar Namecheap saw a 23% revenue increase after adopting Bitcoin payments.

For buyers, Bitcoin is attractive because of:

- Anonymity. Payments without revealing personal data.

- Low fees. Especially via Lightning Network.

- Global accessibility. The ability to pay a seller from anywhere in the world, regardless of relations between states.

- Full control over funds until the moment they reach the seller.

And the most compelling point: if everyone paid and accepted Bitcoin, no one would need to hold fiat currencies that constantly depreciate!

From this list, Bitcoin appears more advantageous for sellers than buyers. Some seller benefits even create buyer drawbacks. For example, the reduction in payment processing fees for sellers is partly explained by the fact that Bitcoin transaction fees are shifted to buyers. Similarly, no chargebacks reduce seller fraud risk but increase buyer vulnerability to scams.

Could this explain Bitcoin’s low adoption as a payment method? Perhaps sellers are willing to accept it, but buyers aren’t eager to spend it? No wonder the Breez and 1A1z report highlights their “brightest achievement”: over 650 million users now have access to Bitcoin and Lightning Network payment infrastructure.

Access to this infrastructure indeed exists. But there’s no observable desire to use it.

What Are Buyers and Sellers Missing in Bitcoin?

Have you ever used Bitcoin for purchases? I’ve used it three times.

- Out of curiosity: To test how it works. Everything worked out, but I can’t say I was satisfied. After all, I left with fewer bitcoins! Bitcoin feels like treasure. Spending it felt wasteful: had I held it, I could’ve bought more later.

- When fiat access failed: My phone broke, taking my digital payment cards and eSIM for online banking. It was a weekend evening, and until Monday morning, I was left completely without fiat money. But I could pay with Bitcoin from my computer, which I did: I found a seller accepting Bitcoin and bought what I needed.

- For a discount: A seller offered a 2.5% discount for Bitcoin payments. I spent bitcoins and used fiat to replenish it, ending up with slightly more bitcoins. The seller also benefited — card processing would’ve cost them more.

As a buyer, Bitcoin works for me when fiat isn’t available. But if I have fiat, I’d rather spend it — it’s less “precious.” Plus, fiat payments have no fees (for me) and allow chargebacks.

Chargebacks are possible in Bitcoin via escrow services. The reluctance to spend Bitcoin could be solved with discounts. If sellers offered discounts for Bitcoin payments, holders might spend more. The Breez and 1A1z report cites MoneyBadger, a payment processor offering Bitcoin discounts. But such cases are rare. Usually, sellers aren’t interested enough in accepting bitcoins to offer discounts.

What’s missing for sellers? What I mentioned earlier: payment methods thrive when buyers and sellers are willing to use them. Sellers doubt whether their sellers — suppliers or partners — will accept Bitcoin. Even if I, as a seller, accept Bitcoin, I’ll likely convert it to fiat for liquidity. This means bitcoins aren’t reducing sellers’ costs but increasing them. What discounts can we talk about in this situation?

What About Other Cryptocurrencies?

Bitcoin is unparalleled as a store of value. It provides both an unprecedented level of security and protection against inflation. But as a payment method, it hardly surpasses other cryptocurrencies.

Today, more and more people are using stablecoins as a payment method. This means that cryptocurrency payment infrastructure will develop around stablecoins. And in the future, those cryptocurrencies whose blockchains will host this infrastructure might find their place in it.

If so, Bitcoin may remain “digital gold” — a reliable store of value. Even this wouldn’t mean failure: Bitcoin excels here. And if the crypto world settles on storing one asset and spending another, we at Rabbit Swap will only be happy about this. After all, this means we can continue to exchange cryptocurrencies — without registration, without limits, and at the best rates — just as we do now.