How to Build a Cryptocurrency Portfolio for 2025

In 2024, the cryptocurrency market continued its dynamic development, offering more opportunities for those ready to invest their funds. Even in the U.S., where financial activities are conservatively regulated, cryptocurrency-focused funds were introduced in 2024. According to CoinShares, these funds experience more frequent asset inflows than outflows.

The end of 2024 will undoubtedly be remembered as a time when many cryptocurrencies experienced significant price increases. However, not all of them did. Some assets surged at astonishing rates, while others stagnated or even declined. Although the year is not over yet, I can’t see any signs that market dynamics will change, with selective price growth continuing rather than transitioning to universal growth.

In such a market, everyone likely wants to find assets that will either help grow their capital in 2025 or at least protect it from the inflation of fiat currencies. However, the task of building a portfolio for the year is very challenging.

Choosing Assets for a Cryptocurrency Portfolio

When purchasing cryptocurrencies for investment rather than for use, the most critical question to ask yourself is: Who will buy this asset from me later?

Not all cryptocurrencies are liquid. However, there are some assets that can be added to a portfolio without fear of being stuck with them indefinitely:

Bitcoin (BTC)

Bitcoin is the only cryptocurrency whose exchange for dollars at market rates is guaranteed by a state (El Salvador). However, this factor is unlikely to be decisive for most Bitcoin buyers. Bitcoin’s demand stems from its reliability as a storage of value, secured within the blockchain, where assets cannot be confiscated or frozen. The blockchain’s security is underpinned by an unprecedented level of computational power provided by miners and users verifying blocks.

Cryptocurrencies for Blockchain Fees

Some cryptocurrencies are essential for transaction fees in widely-used blockchains:

- Ethereum (ETH): The asset for paying decentralized applications (dApps) and smart contracts in both Ethereum’s main network and some Layer 2 solutions like Base. As long as dApps and smart contracts remain in demand, ETH will retain value and be sellable.

- Tron (TRX): Many users rely on the Tron blockchain for transferring the most popular stablecoin, USDT, and each transfer requires TRX.

Cryptocurrencies Valued by Developers

These assets play a crucial role in blockchain innovation:

- Solana (SOL): Known as the leading platform for launching meme tokens, Solana powers tools like pump.fun, which require SOL tokens. Developers launching meme tokens in large communities need SOL.

- Polkadot (DOT): A network of interconnected blockchains, Polkadot validates and stores data for each connected chain. New crypto projects that cannot independently maintain a blockchain can integrate into Polkadot for added security and stability. Maintaining a standalone blockchain is a complex task — even large projects like TON and Solana have experienced outages. This ongoing challenge ensures a continued need for ecosystems like Polkadot, which allow new blockchains to integrate into a reliable network. As a result, demand for DOT tokens, required for network fees, is expected to remain strong.

Cryptocurrencies for Traders

Some assets cater specifically to the needs of traders:

- Binance Coin (BNB): Offers fee discounts on Binance, the largest cryptocurrency exchange, and allows participation in exclusive token sales. As long as Binance is popular, demand for BNB will persist.

- Similar tokens exist on many other crypto exchanges, but not all of them are equally useful for traders. For example, the exchange Storm Trade, like Binance, issues its own tokens STORM, but these tokens can only be used for staking to earn returns in the same tokens. They have no other utility. As a result, the income from STORM tokens is ephemeral. What can you do with the tokens you earn? Nothing. You can try to sell them, but who would buy them and why? Until there is an answer to this question, the token’s prospects remain highly uncertain.

- Some DEX ecosystems rely on native tokens for transaction fees. For instance, decentralized exchanges on Stellar have been around far longer than the DeFi boom of 2020–2021, which introduced platforms like Uniswap, dYdX, 1inch, and many other well-known exchanges. Stellar’s longevity suggests that demand for its token, Lumens (XLM), will likely persist.

For other assets, if you don’t clearly understand who might want to buy them and why, it’s best to exclude them from your portfolio.

In the most conservative approach, you can build a portfolio consisting only of the cryptocurrencies you personally use. For instance, if you:

- rely on tokenized gold (PAXG, ERC-20) as your primary tool for inflation protection and exchange it as needed for stablecoins or other crypto assets on the Rabbit Swap platform,

- transfer stablecoins to family members via the Tron blockchain,

- trade actively on Binance,

- create digital art objects,

- saving the best pieces as inscriptions on the Bitcoin blockchain for eternal storage,

- and selling the rest as NFTs on specialized marketplaces like Objkt (in the Tezos ecosystem) or Xchange.art (in the Solana ecosystem),

then an optimal portfolio for you might consist of ETH, TRX, BNB, BTC, XTZ, and SOL. Even if you cannot sell these assets at a profit, you will still be able to use them to cover fees for the services you use.

While this strategy may not guarantee passive income, it ensures that your assets won’t become dead weight in your wallet.

What Cryptocurrencies Will Yield Profit in 2025?

For a cryptocurrency’s value to rise, it requires:

- Growing demand.

- Controlled or decreasing supply: ideally shrinking, or at least growing slower than demand.

Forecasting these metrics for different cryptocurrencies is challenging. A cryptocurrency’s value often depends more on popularity than utility. And what will be popular in 2025?

- Influential figures like Changpeng Zhao and Vitalik Buterin promote areas like DeSci, but whether public interest will grow is uncertain.

- Tokens tied to AI agents, such as GOAT, have gained traction, with its market cap reaching $1 billion within a month. However, the sustainability of such trends in 2025 is unknown.

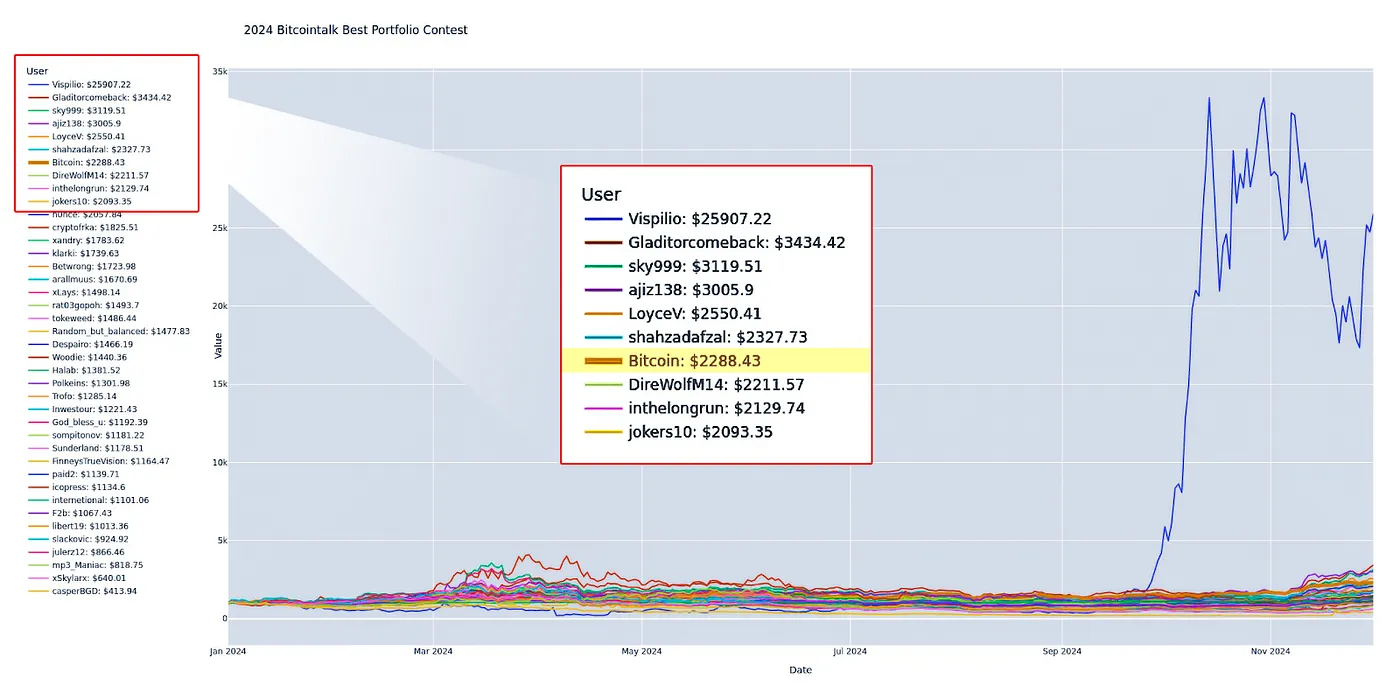

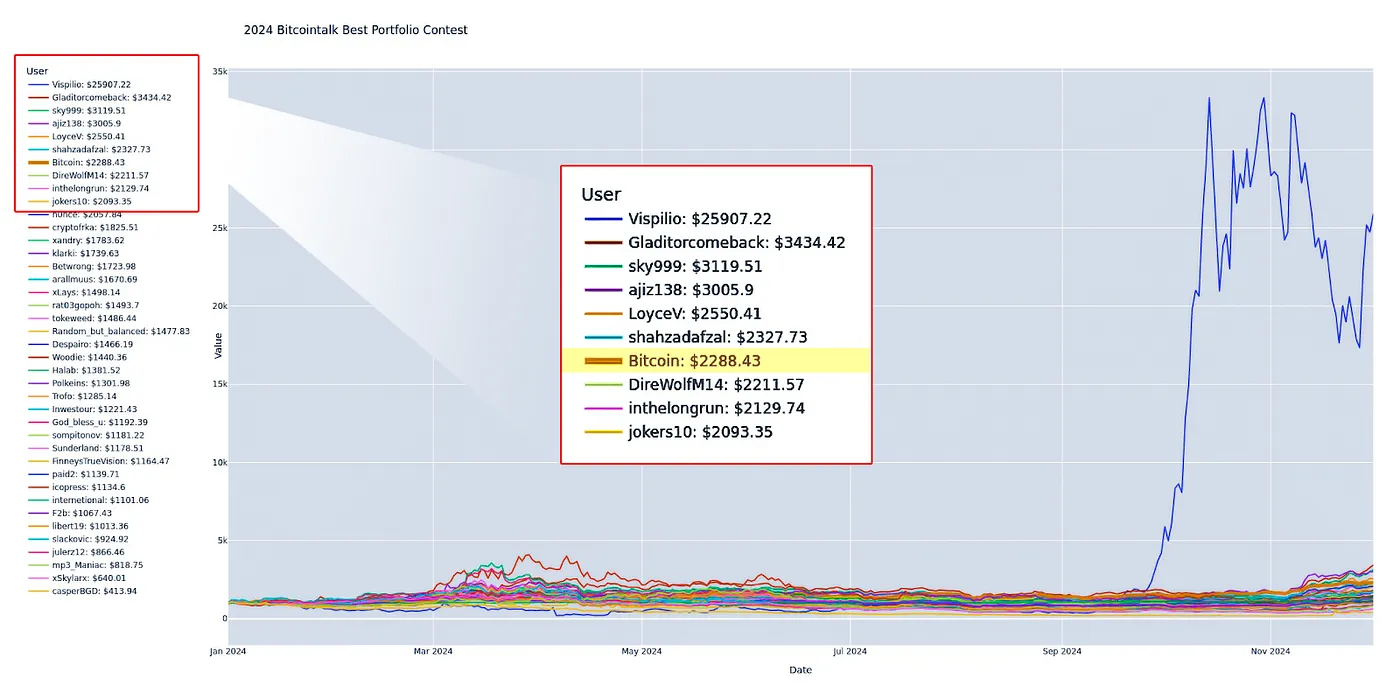

On the Bitcointalk forum, an annual cryptocurrency portfolio contest provides valuable insights. The current round began just before the start of 2024. The contest required participants to build a $1,000 portfolio with four cryptocurrencies, excluding Bitcoin and allowing only one stablecoin.

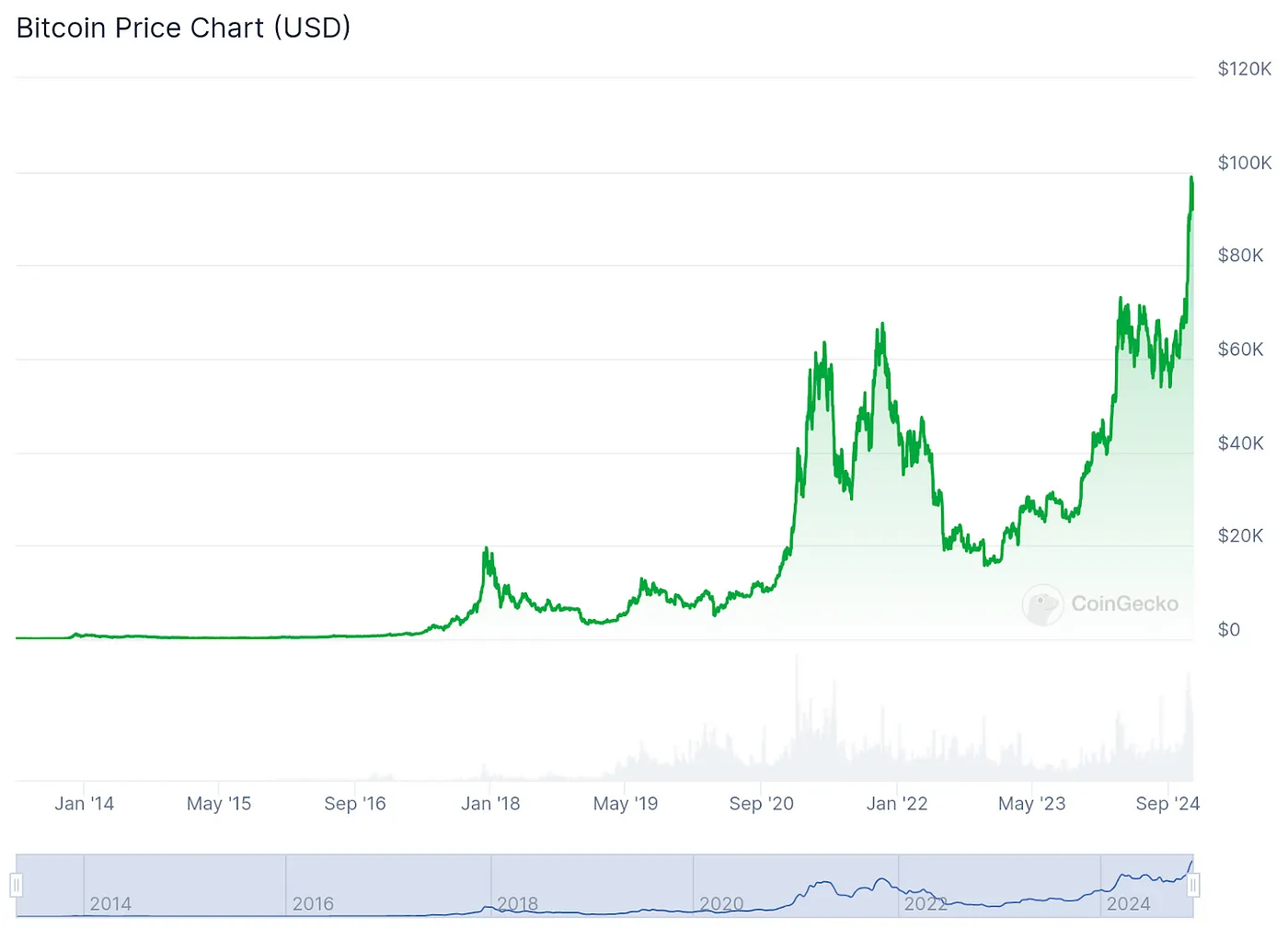

The contest features 39 portfolios, plus a 40th portfolio consisting entirely of Bitcoin. Despite varied strategies, a pure Bitcoin portfolio consistently ranks high, highlighting its reliability. As of December 1, the Bitcoin portfolio ranks 7th.

At the time of writing, $1,000 invested in Bitcoin at the start of the year would have grown to $2,288.43. In contrast, 33 of the 39 altcoin and stablecoin portfolios delivered lower returns. However, the leading portfolio achieved a remarkable 25x growth in its initial capital.

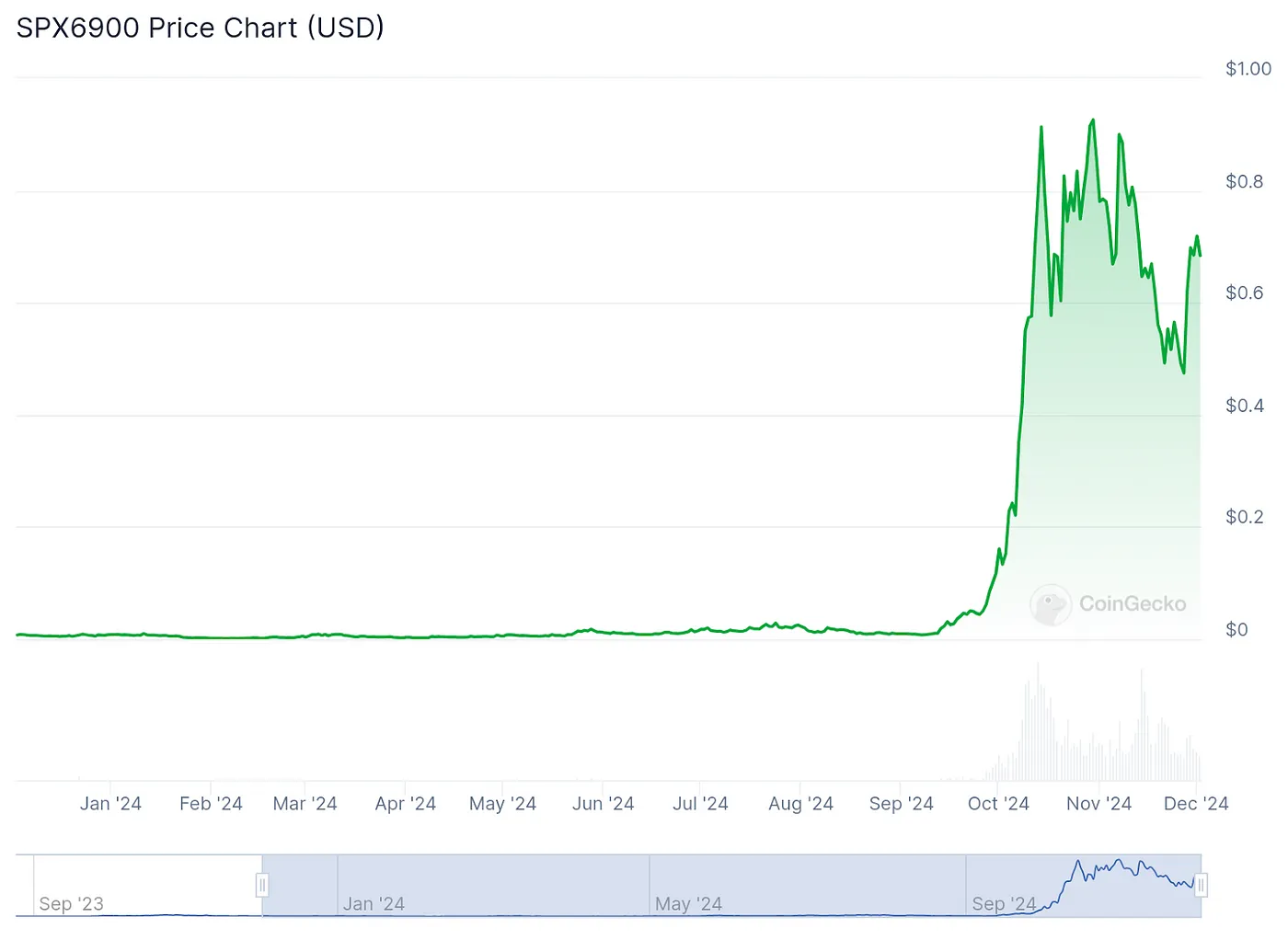

The top-ranking portfolio in the contest included the tokens Black, Nola, SPX6900, and ChartAI. Three of these tokens suffered significant losses over the year, but the exceptional growth of SPX6900 more than compensated for these declines.

As we can see, selecting lesser-known cryptocurrencies can occasionally lead to impressive results. However, in most cases, choosing reliable, proven options proves to be the optimal strategy. Year after year, observing this contest reinforces my belief that a portfolio composed entirely of Bitcoin is the best choice for the average crypto investor.

Even if Bitcoin’s price movement doesn’t yield passive income in 2025 — which is possible given its current levels near all-time highs — such income will come eventually. The entire evolution of the fiat system drives people away from its savings framework, and Bitcoin remains the most reliable alternative. This consistent demand growth, coupled with Bitcoin’s strictly limited supply — guaranteed by the issuance algorithm designed by Satoshi Nakamoto — ensures its long-term value.

Additional Considerations for Building a Portfolio

In addition to the process of selecting cryptocurrencies, building a portfolio should also take into account general investment principles.

For example, I carefully analyzed cryptocurrencies and concluded that I cannot predict their performance. Thus, my portfolio for 2025 will consist entirely of Bitcoin. Is this acceptable? For me, yes. But from the perspective of a traditional investor, it is not advisable. A typical investor usually focuses on three factors when building a portfolio: balance, acceptable risk levels, and investment horizon.

Balance

Balanced portfolios include assets with varying levels of risk.

Cryptocurrencies like Bitcoin and Ethereum are considered more stable and predictable assets. Not in the sense that we can be sure Bitcoin will exceed $100,000 or Ethereum $4,000 in 2025, but in the sense that their prices are unlikely to drop by an order of magnitude or rise dozens of times.

Meanwhile, meme coins and GameFi tokens are more volatile. They may experience explosive growth, but they can also lose almost all their value.

A balanced portfolio reduces risks, as the decline in one asset’s value can be offset by the growth of another.

Unbalanced portfolios are often filled with cryptocurrencies from the same segment — for example, RWA (real-world asset tokenization) or Layer 2 solutions (secondary layers built on main blockchains). This can be a profitable strategy if the chosen segment performs well. However, such portfolios carry significant risks, as a simultaneous drop in all assets within one segment can occur.

A portfolio consisting only of Bitcoin is an unbalanced portfolio.

Risk Tolerance

Conservative portfolios are designed for asset holders who prefer to minimize risks. As I demonstrated above, the ultimate conservative portfolio consists of assets that an investor could personally use, losing virtually nothing in the worst-case scenario.

Moderate portfolios are created by asset holders who are willing to take on some risk in exchange for increased potential returns. These portfolios include both stable assets and more volatile ones that might generate high profits.

Aggressive portfolios are built by individuals actively seeking maximum profits and willing to risk their entire crypto investment capital. These portfolios may include many high-risk assets, such as meme coins that grow solely on hype. Often, these portfolios focus on low-cap coins that could quickly gain value but might also sharply depreciate.

Interestingly, in terms of risk, a Bitcoin-only portfolio is closer to aggressive portfolios. This is because all the investment is concentrated in one asset. If a quantum computer unexpectedly appears in 2025, rendering Bitcoin’s encryption model obsolete, such a portfolio could lose all its value. At the same time, in terms of expected returns, such a portfolio is more akin to conservative ones. Few would expect Bitcoin’s price to multiply many times over in 2025.

Investment Horizon

Short-term portfolios are built by those looking to make a profit within weeks or months. When creating a portfolio for 2025, the owner of a short-term portfolio does not plan to keep it in the same state for the entire year. They might actively exchange one cryptocurrency for another, leveraging price fluctuations for quick gains. At Rabbit Swap, we see many such clients who, during Bitcoin price increases, exchange it for something more stable and re-add Bitcoin to their portfolio when prices drop.

Medium-term portfolios are designed for periods of six months to a year. These include assets that are expected to show stable growth over this period, though the owner is prepared to endure temporary declines. Medium-term portfolios also work well with Rabbit Swap services — we have clients who return for portfolio rebalancing every six months or less frequently.

Long-term portfolios are built for several years and focus on the sustained growth of assets. Such portfolios usually include cryptocurrencies with proven track records, demonstrating that downturns are always followed by recoveries, and the overall price trend is consistently positive. Perhaps a portfolio consisting solely of Bitcoin is truly suitable only for this type of investment.

Conclusion

When crafting a cryptocurrency portfolio for 2025, keep in mind:

- Invest in assets with clear utility for you or others.

- Over a year or more, Bitcoin often outperforms most altcoins.

- Some altcoins may still deliver exponential gains.

- Build a balanced portfolio based on your risk tolerance and investment horizon.

- If uncertain, stick to Bitcoin — it remains the safest long-term option.