From ETF to Banana and Beyond

In 2024, spot ETFs for Bitcoin and Ethereum were launched in the United States. Each investment in such funds must be backed by actual cryptocurrency purchases. This means that every dollar flowing into these funds directly translates into crypto purchases.

But what if these funds decide to sell their crypto? Will they be able to get back the dollars they initially spent? The answer depends on where that money ended up. I tried to map out the possible path of the funds that entered the crypto market in 2024, and here’s what I came up with.

Bitcoin and Ether Prices Soar

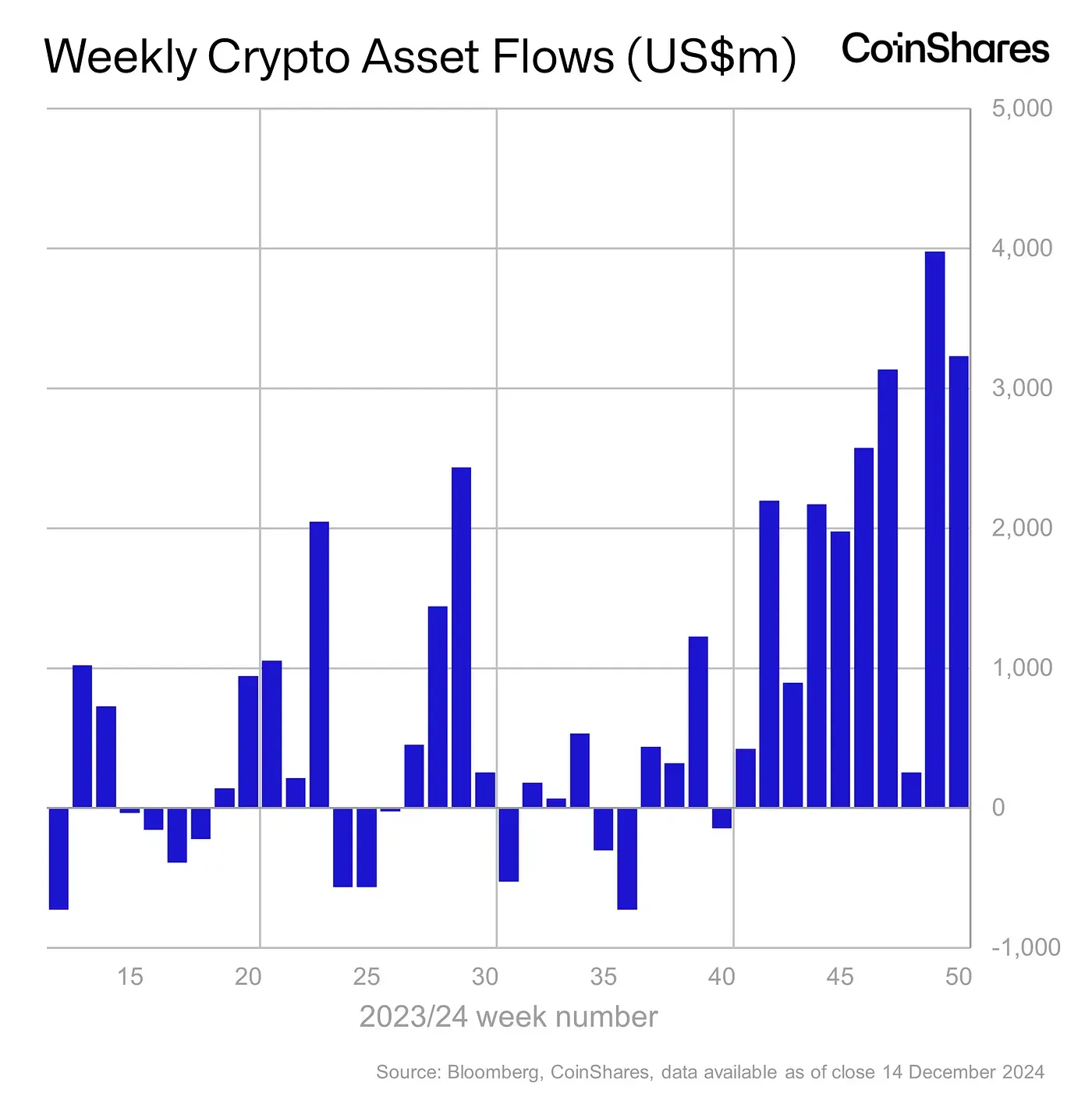

According to CoinShares, total inflows into cryptocurrency funds in 2024 amounted to $44.5 billion. In other words, institutional investors in the U.S. indirectly purchased crypto worth this amount (excluding fund management fees).

Naturally, such massive purchases pushed cryptocurrency prices upward, particularly Bitcoin, which saw its ETFs launched at the beginning of the year.

Bitcoin’s price in 2024 climbed from $40,000 to $100,000 — an increase of 2.5 times. Some might argue that tens of billions of dollars shouldn’t have such an outsized impact, considering Bitcoin’s market capitalization is close to $2 trillion, as reported by CoinMarketCap. But it’s important to note that only a small fraction of Bitcoin is freely available on the market. On Coinbase, the largest platform where Bitcoin trades against the U.S. dollar, the entire sell-side order book could be bought out for less than $500 million.

Initially, Ethereum ETFs didn’t attract the same inflows. However, once investors turned to these funds, Ether price experienced significant growth as well.

So, the influx of money from U.S. institutional investors boosted the prices of Bitcoin (quite significantly) and Ether (to a lesser extent). Those funds went to people who were holding these cryptos beforehand and decided to sell. What happened next?

Shifting Funds to Other Crypto Projects

Those who owned Bitcoin before 2024 saw their wealth surge as its price skyrocketed. Yet, even after selling their Bitcoin, most didn’t withdraw their profits from the market.

A scene from The Wolf of Wall Street illustrates this dynamic perfectly. A broker explains to a new employee how markets work: if a client makes a profit, the broker’s job is to prevent the client from cashing out. Instead, the broker offers new investment opportunities, enticing the client to aim for even bigger paper profits.

Markets often grow for this reason — profits are rarely withdrawn. The crypto market is structured similarly, incentivizing participants to keep their money in play. After Bitcoin’s price rise created newfound liquidity, retail investors turned to fresh opportunities to grow their capital further:

- Altcoins that hadn’t yet experienced major surges.

- Meme tokens with the potential for massive, multi-thousand-percent returns (since Bitcoin’s growth can no longer match this scale).

- Donations to GameFi projects in hopes of receiving token airdrops.

- Staking, farming, lending, liquidity pools, and other passive income opportunities.

What are we witnessing now? The rise of altcoin prices, a meme token boom, the popularity of clicker games, and a surge in DeFi total value locked (TVL). This confirms that retail investors, whose capital grew due to Bitcoin’s price increase, didn’t withdraw their profits but redirected them to other crypto projects. So, who ultimately ends up with this money?

The Million-Dollar Banana

The funds flowing into the market, thanks to U.S. institutional investors and retail participants, ultimately landed in the hands of the organizers behind these projects — those managing altcoins, meme tokens, blockchain games, and DeFi services.

A striking example of such an organizer is Justin Sun, whose empire includes exchanges, altcoins, blockchain games, and a platform for launching meme tokens.

In late 2024, Justin Sun made headlines for purchasing a piece of art made from a banana duct-taped to a wall for $6.2 million — only to destroy it by peeling the banana off and eating it.

So this is where the dollars brought to the crypto market by U.S. institutional investors ultimately go! These funds aren’t spent by the investors or even by those who sold them the cryptocurrency. Instead, they end up with the organizers of this sprawling cryptocurrency industry.

This reminds me of casinos: some players lose, some win, winners play again, and eventually, the money flows into the hands of the casino operators, who spend it as they please.

Do the Crypto Moguls Take All the Profit?

A casino can generate sustainable profits and operate as an honest business, but only if players gamble with their own money. In such cases, it’s an exchange of money for entertainment, with no lingering obligations. However, if players gamble with borrowed funds, the “money for emotions” model breaks down. When businesses ruin lives while organizers continue to profit, many see such enterprises as unethical or even fraudulent.

The “organizers” of the crypto hype have convinced everyone that cryptocurrency isn’t a risky venture investment but a super-reliable, safe asset — “digital gold” that has consistently grown in value for 15 years. This allure tempts people into investing their money, believing it will make them rich.

Surprisingly, even institutional investors have now joined this game, bringing their funds into an arena previously dominated by retail “gamblers.” Could the organizers — figures like Justin Sun — have deceived the managers of large, reputable funds?

Perhaps not all the money was wasted on bananas? Maybe most of it remained within the market? But here I recall other high-profile stories involving the “organizers” of the crypto business:

- Terraform Labs paid a $4.47 billion fine.

- Binance paid a $4.3 billion fine.

- Jump Crypto agreed to settle SEC claims for $123 million.

- Silvergate Bank, which served the crypto industry, paid $63 million in a similar situation.

And this is just within the United States.

Compared to these figures, the banana purchase seems like child’s play. It seems the real winners of the crypto market boom are governments. Which means it may not have been Justin Sun and other crypto moguls who tricked the fund managers after all. The biggest beneficiaries might be lurking somewhere else entirely.

What We’re Left With

In 2024, institutional investors spent tens of billions of dollars on Bitcoin and Ether. If they try to sell them to recoup their dollars, here’s what they’ll discover:

- Those who sold the cryptocurrency no longer have the money (if you sold in 2024, you know this well).

- The money migrated to all sorts of questionable crypto projects.

- The organizers of these projects enriched themselves but spent part of the money on frivolous things like bananas.

- The largest share of funds went straight to governments.

As a result, reclaiming all the dollars invested in cryptocurrency is no longer possible.

Is There a Solution?

Even if our fiat currency is gone for good and we can’t get it back, there’s still a chance to break this cycle — and it’s easier than you might think.

Let’s stop relying on fiat currencies! When you provide a service, create a product, or perform valuable work, request payment in cryptocurrency instead of fiat. Let fiat currencies stay with those who’ve taken them. Ordinary people can always transact in cryptocurrencies, which cannot be seized as easily.

And if you hold Bitcoin but your counterparty requests payment in something like Ether, Monero, or even GOAT tokens, Rabbit Swap is here to help. With just a couple of clicks, you can exchange one cryptocurrency for another at the best rate — no sign-up, no limits, no bullshit.