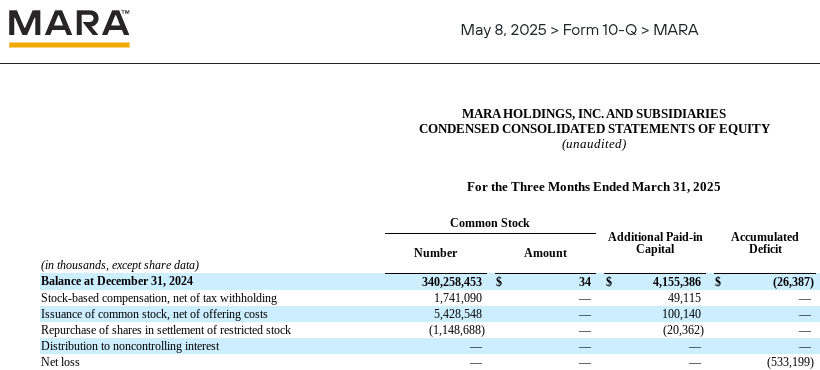

One of the largest Bitcoin miners posted a $533M quarterly loss

MARA Holdings, one of the largest public Bitcoin miners, has reported a $533 million loss for Q1 2025. It’s a paper loss (mostly a write-down of previous gains), but what caught our attention were the operating figures.

MARA’s electricity cost to mine a single BTC was $35,728 - based on an energy rate of $0.04 per kWh.

And that’s just electricity. Miners also spend heavily on:

- hardware (purchase, depreciation, insurance),

- hosting (facility rent, cooling, maintenance),

- and, most significantly, taxes.

To stay afloat in this business, you need to be the kind of company that can absorb a half-billion dollar quarterly loss without going under. That’s a high bar.

I’ve said it before: Bitcoin’s high barrier to entry for mining is a structural weakness.

Thankfully, Bitcoin isn’t the only game in town. Other cryptocurrencies are helping carry the torch of financial decentralization - with more inclusive models.

Take Monero, for example. It’s famous for private transactions, but there’s more under the hood. Monero’s mining algorithm is optimized for fairness - meaning almost anyone can mine it successfully, even without expensive gear.

By the way, BTC → XMR is consistently one of the most popular swap pairs on rabbit.io.